by John Service

Espresso is an fascinating factor. Other than the aroma, taste, and attract of an excellent cup, understanding some issues about espresso economics could be its personal fascinating lesson. If nothing else, (the beautiful economics lesson to observe) will hopefully enable you to perceive among the issues that assist decide the value of the espresso in your cup and presumably admire its worth.

So class, with caffeine-laden espresso shut by (typically wanted when discussing the science of economics) please open your macroeconomics textbook and we’ll leap proper in …

First, it’s vital to comprehend that espresso is a globally traded commodity identical to oil. Espresso is the second-most traded commodity, oil being the primary. Espresso is mostly traded in monetary devices often called futures contracts, and that is primarily achieved by means of the New York Board of Commerce. A futures contract is a standardized contract to purchase or promote a sure underlying instrument at a sure date sooner or later at a specified worth. Within the case of espresso, every futures contract entails the management of 37,500 kilos of inexperienced espresso (250 baggage, which is what often suits in a typical delivery container for abroad transport).

Delivery Containers

The New York Board of Commerce is the designated futures market and unique international market for Espresso “C” futures contracts. In these futures and choices contracts, the worldwide worth for espresso is found on any given day. Actually, the value of espresso is a each day, even minute-by-minute discovery course of.

Buying and selling flooring on the New York Board of Commerce

The “C” contract pricing is pushed up and down by variables like altering climate situations within the main producing international locations, political turmoil, hypothesis about manufacturing ranges, altering transportation prices (again to that pesky oil!), and different sudden elements. That phrase “sudden” is vital. For instance, information of a potential drought or freezing situations in coffee-producing areas would doubtless cut back international provide and thereby improve costs. Assuming demand stays the identical, the decreased provide would drive up costs with the intention to obtain a market-clearing worth.

The “C” seems at washed Arabica espresso produced in a number of Central and South American, Asian, and African international locations to determine the “foundation” for the contract. Coffees judged higher are at a premium and naturally, these judged inferior are at a reduction. After all, this all primarily pertains to inexperienced espresso costs. Roasted espresso, whether or not purchased straight from a roaster, the grocery retailer, or within the type of a beverage, is a special product that has different elements affecting its final worth.

Since espresso importers and huge brokers primarily promote in opposition to substitute costs (the value to pay with the intention to exchange espresso offered to end-consumers), much like how gasoline distributors do, when the “C” goes up, so do espresso costs. These commodity markets could be fairly risky (referring to the magnitude of worth actions), which is why you typically see pretty vital strikes within the worth of gasoline on the pump. The identical factor occurs with inexperienced espresso when the variables affecting the market worth get somewhat loopy. So, the costs espresso suppliers pay to make espresso accessible to shoppers are vastly affected by the worldwide espresso commerce in the identical method native gasoline costs are affected by the worldwide oil market.

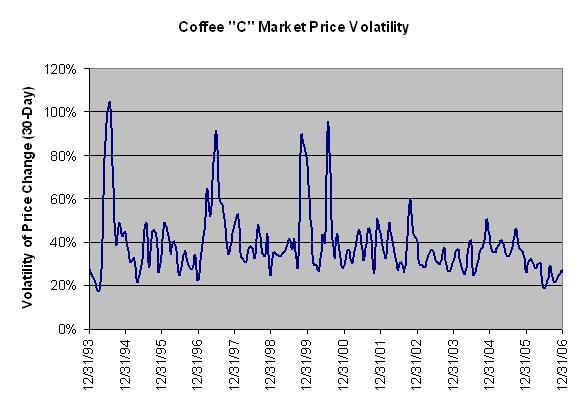

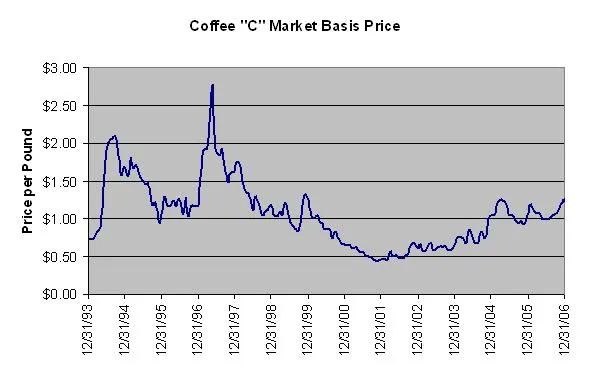

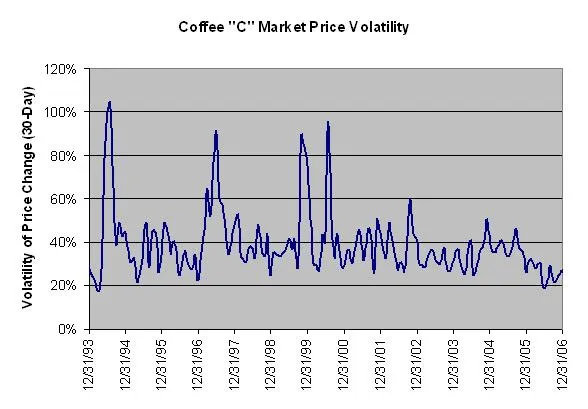

The financial ideas at work are the identical whether or not the commodity in query is gasoline or espresso. For some perspective, I’ve included a graph of the historical past – again to 1994 – for the “C” historic month-to-month contract worth in addition to the month-to-month volatility simply to point out how a lot international espresso costs can fluctuate (knowledge from www.nybot.com).

Espresso “C” Market Foundation Value

Espresso C Market Value Volatility

Espresso importers have a tendency to cost their inexperienced espresso primarily based on the going market charge. Nonetheless, because the espresso makes its method by means of the layers of middlemen, whether or not inexperienced espresso distributors provide house roasters or business roasters provide ready-to-brew merchandise, the costs typically grow to be extra rigidly primarily based. In different phrases, the espresso the end-consumer purchases doesn’t transfer round in worth fairly a lot because the espresso exchanged on the earlier phases of the espresso supply mechanism (on the export/import degree).

The market charge pricing methodology is of course extra clear than the regular, inflexible pricing. The espresso market could be very risky, even over very quick durations. Nonetheless, anticipating all espresso shoppers to simply accept dramatic worth fluctuations would doubtless be a really poor determination on the a part of the espresso suppliers, significantly as a result of individuals don’t like or settle for speedy change all that nicely. Leaving espresso costs paid by end-consumers to fluctuate at market costs would little question result in confusion and annoyance much like what many individuals really feel when stopping to replenish their car with gasoline nowadays when the gasoline worth modifications are very apparent.

General, there are a lot of shifting components within the strategy of getting espresso off the farm and into your cup. Every half represents a novel and often altering worth element as nicely. Even with all of the shifting components and middlemen, the worth of a contemporary cup of espresso could be nice – typically nicely past the 15 cents or so that somebody roasting their very own espresso would possibly spend to have a beautiful sensory expertise.

UPDATE: After this text was launched, the New York Board of Commerce (NY BOT) modified its identify to ICE Futures U.S. (ICE).

References

ICE Futures U.S. – Previously often called the New York Board of Commerce (historic “C” futures contract pricing)

Wikipedia, the Free Encyclopedia (photographs used are within the public area)

Revealed on