On the time of this writing, the near-futures espresso costs on the ICE trade (a.okay.a. the “C value”) was sitting at an all-time excessive of round US$4.03 per pound.

The comparatively excessive value of espresso is the stuff of headlines in monetary, mainstream and commerce publications nowadays, which begs one elementary query: What is the worth of espresso?

For one individual wandering alone within the espresso universe, the “value” could imply the price of a vanilla latte on the espresso store down the road; whereas, in one other galaxy, the worth could also be related to picked espresso cherries being loaded onto the mattress of a truck.

In between these two wildly completely different manifestations of value in espresso, there are actually dozens of various value occasions — moments during which a value is ready and agreed upon by a number of events — in any seed-to-cup espresso chain.

Listed below are a couple of widespread examples: unprocessed espresso costs paid to farmers at post-harvest processing mills; baseline costs set by authorities businesses inside producing nations, or by certification schemes reminiscent of Fairtrade; benchmark inexperienced espresso costs on varied commodities markets; reference costs established by intergovernmental businesses such because the Worldwide Espresso Group; “spot” costs, FOB costs or different identifiers used between merchants and roasters; or retail costs of 12-ounce luggage of espresso or a 12-pack of pods.

But for causes unknown — besides, maybe, for New York Metropolis’s historic standing as a gatekeeper of economic commerce — a lot of the skilled espresso world returns many times to a single benchmark, generally often called the “C value,” for espresso.

Regardless of being controversial, convoluted, broadly misunderstood and considerably arbitrary, the one C value does present some stability within the espresso commerce, permitting for value “discovery” amongst market members.

On the time of this writing, the C value reached all-time highs, hovering round US$4 per pound, commanding headlines all through the mainstream media and drawing out sizzling takes from all types of market and trade analysts.

Usually missed in these conversations is even a obligatory clarification of the particular value reference. The place did this $4 determine come from? Who got here up with it? And why is the espresso trade nonetheless utilizing it?

Now appears pretty much as good a time as any for some clarification.

What Is the C Worth for Espresso?

In easiest phrases, the C value is a extensively referenced benchmark value for inexperienced (unroasted) arabica coffees, which have traditionally been thought-about larger high quality than robusta coffees. Usually confused as a logo for “Espresso” or “Commodity,” the “C” within the “C value” truly stands for “Centrals,” a vestige from when Central American espresso producers needed to distinguish their coffees from these of Brazil.

Technically, the “C” at present is a contract specification on inexperienced espresso futures contracts on the Intercontinental Trade (ICE) in New York. It’s by this ICE trade — a monetary software by a non-public firm, working much like a inventory trade — that the C value is established as a benchmark.

When merchants take part in these futures contracts, they’re basically betting on what they imagine the worth of arabica espresso might be at a future date. Consumers and sellers conform to commerce a certain amount of espresso for a set value at a later time. The end result of this buying and selling offers the broader espresso market a reference level — the so-called “C value.”

How Has the C Worth Modified Over Time?

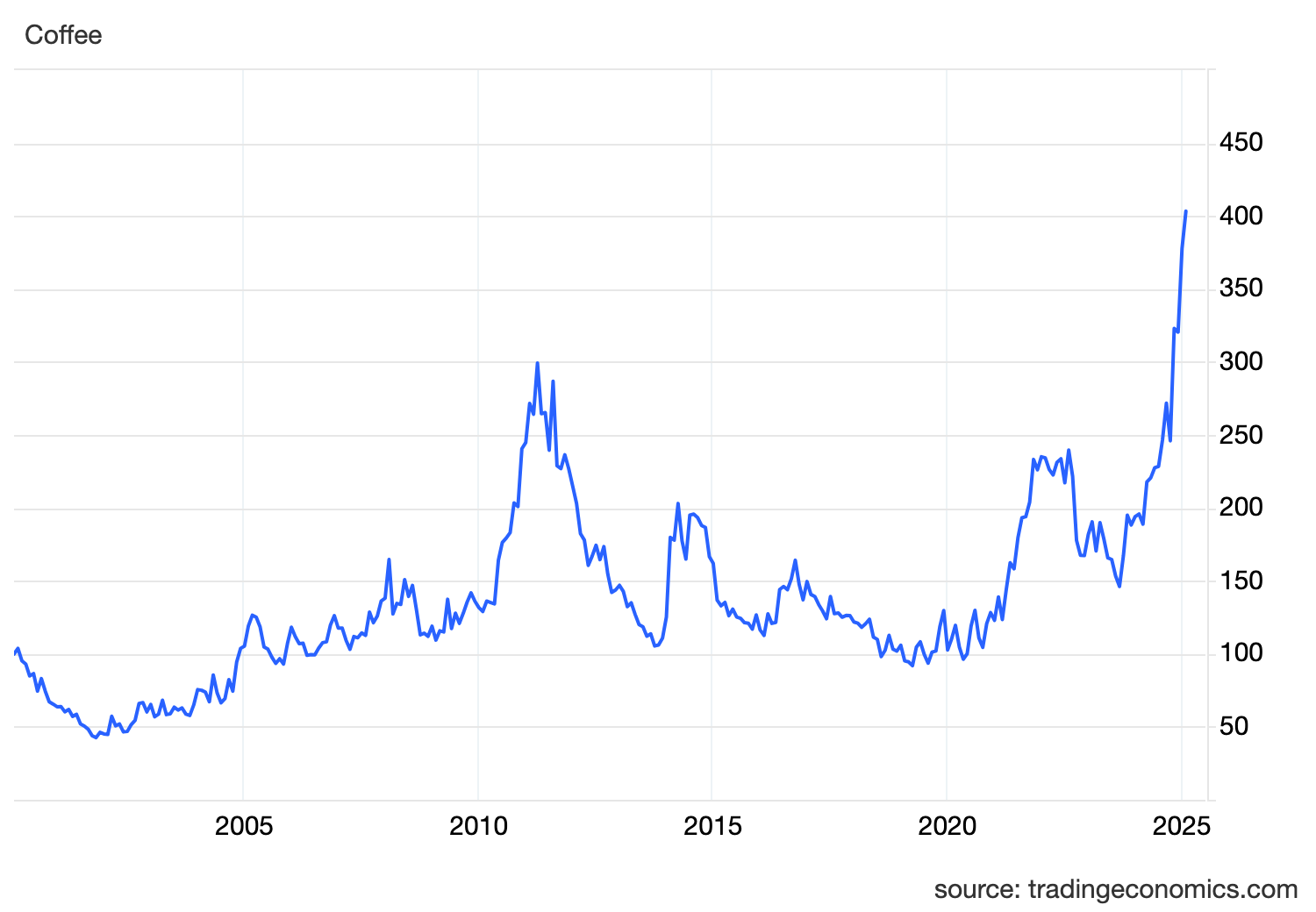

The standard espresso market, like many different commodities markets, is cyclical. Historic information exhibits durations of sharp spikes adopted by steep declines, reflecting adjustments in provide, demand, climate situations and broader financial components. In espresso and different agricultural items, costs have additionally mirrored a increase and bust cycle, during which excessive costs result in extra crop planting and manufacturing, which in flip could result in decrease costs.

But up till 1989, the espresso market was regulated by a sequence of Worldwide Espresso Agreements (ICA), which had been supposed to handle provide and keep value stability by a quota system. Following the free market ideology of the Ronald Reagan administration, plus different ideological conflicts between key producing nations and key consuming nations, notably Brazil, the US finally left the settlement.

The free market period since that point has been a interval of maximum value volatility, as mirrored within the C value. Here’s a broad overview of some key durations in current historical past.

- 1989-1994 and 2000-2004: After the collapse of the ICA in 1989, costs fell dramatically. Inside two completely different durations, the market skilled a espresso “value disaster,” with costs remaining beneath $1.00 per pound for consecutive years.

- Early 2010s: Costs rose considerably attributable to espresso leaf rust illness that hampered espresso manufacturing all through a lot of Mexico and Central and South America.

- 2017-2020: Costs attain one other “disaster” interval for producers, with the C value sinking to under $1 beginning in early 2018.

- February, 2025: The C value for the primary time exceeds $4.

The Position of Funds and Hypothesis in Volatility

Importantly, the C Worth shouldn’t be dictated solely by the bodily trade of espresso. As an alternative, it’s closely influenced by market members who could by no means deal with a single inexperienced or roasted espresso seed.

Hedge funds, giant funding companies and particular person speculators purchase and promote espresso futures primarily based on their market outlook or technical evaluation. These speculative actions can amplify value actions, generally pushing the C value larger or decrease than conventional supply-and-demand fundamentals would dictate.

An Arbitrary Marker

Whereas the C value stays central to the worldwide espresso commerce, it’s arguably considerably arbitrary as a result of it’s formed by futures merchants and monetary establishments, whose motivations can vary from hedging threat to short-term revenue.

Because of this sudden adjustments in investor sentiment, relatively than shifts in bodily espresso provide or demand, can affect the worth, creating uncertainty for producers and consumers alike.

Espresso costs, and particularly the “C value,” are sure to proceed to seize headlines in 2024, particularly in giant shopper markets the place merchants and roasters could also be paying larger costs for inexperienced coffees.

But it’s essential to keep in mind that the C value is a man-made goalpost in what many market members think about to be the sport of espresso. It’s a man-made monetary product, and never essentially a mirrored image of the realities dealing with espresso farmers, roasters, shoppers or different individuals who prize espresso as one thing greater than a sequence of numbers and arrows.

Feedback? Questions? Information to share? Contact DCN’s editors right here. For all the newest espresso trade information, subscribe to the DCN e-newsletter.

Associated Posts

Nick Brown

Nick Brown is the editor of Day by day Espresso Information by Roast Journal.